What defines Accfam?

Technology for timely collecting accounting information across countries has continued to evolve in the global business environment. However, the development and training of human skills to properly analyze foreign accounting information is not yet sufficient. The fundamental managerial function of accounting, which involves steering the management based on accounting information, becomes significantly more difficult when it crosses national boundaries.

Accounting information cannot be properly understood without knowing the meaning of the numbers and their history, such as local accounting and tax systems, regulations, business practices, and prices in that country.

At Accfam, we specialize in developing skills to numerically analyze foreign business operations from a perspective of the head office, by organizing the necessary knowledge of each country to fully understand overseas accounting information, and collaborating with local experts. Our goal is to become the leader of overseas business operations of our clients.

The overseas audit business, which is Accfam ‘s main business, has the following features:

GOAL : Customer and Social Benefits

Accfam actively transfers technology to customers to ensure that the effective overseas audits are carried out in more companies that will contribute to business growth. We are dedicated to carry out the business, considering what is best for our customers and ultimately for society in our business, rather than only looking at our own profits.

PURPOSE : Overseas Audit as Consulting

Accfam PURPOSE IS TO AID the local business which is THE target of AN audit. Instead of just listing things that are not done, we aim to contribute to solving issues for managers of both the head office and local office by sincerely facing the local management from a company-wide management perspective in accordance with the situation and risk preferences of the company. For this purpose, we focus on developing experts who are familiar with the legal and regulatory systems as well as commercial practices in each country. Building a knowledge infrastructure database for each country which is the prerequisite knowledge necessary for overseas audits.

SCOPE : Post-Audit Management Execution Support

One of the biggest dissatisfactions with audits is that they end up with criticism and direction, but leave the implementation of improvements to the local staff. In particular, the fact that many expatriates dispatched to the local area are former sales or technical personnel who are not familiar with management and spend a lot of time on managing requests from the head office is a big factor hampering local business growth. Accfam collaborates with local firms from planning to implementation support to solve the problems of local management at the request of clients.

FLEXIBILITY : Various Overseas Audit Support Service Menus

Flexible support measures can be designed according to your budget and needs, including guiding the internal audit training without accompanying the actual audit, accompanying interpreting, acting as a proxy for the internal control process audit, compliance with local laws and internal regulations audit, fraud risk audit, etc., using our expertise.

QUALITY : Overwhelming Quality of Service

- [SPECIALIZATION] Accumulating Expertise With Overwhelming Case Experience Specialized in Overseas Auditing Technology

It is no secret that the quality of accounting reporting done overseas, especially in emerging countries, tends to be very low even after going through the audit. On the other hand, it is difficult to effectively conduct overseas audits from a perspective of the head office, and many companies are struggling to cultivate personnel for such tasks internally. Therefore, a group of professionals are required, which is one of the reasons why we launched a specialized overseas auditing business. As it is not enough to foster expertise as one of many services and resources are also dispersed, we specialize in overseas audit technology and accumulate knowledge and experience to provide an overwhelming overseas audit service. We started by handling cases with little compensation, accumulated knowledge through trial and error, and improved the quality of our service. We believe that we can provide value to our customers because we have a track record of successful cases. - [FRAUD RESPONSE] Response to Financial Fraud Risks

Modern auditing procedures are considered to be almost powerless against financial fraud, particularly in emerging countries. The reality is that modern accounting audit procedures are hardly effective against fraud that involves the risk of collusion. In fact, in addition to the cases that have been publicly disclosed, there are actually many incidents of financial fraud such as embezzlement, falsification, and corruption. Accfam regards this financial fraud and vulnerability in management as one of the important factors that hinder the growth of public-private overseas business investments and pursues auditing techniques to uncover fraud in a short period. Even for audit experts and fraud investigation experts in Japan, overseas financial fraud cannot be detected without local knowledge, including local commercial practices, feasible fraudulent methods and typical techniques, and market views. Accfam has established an overseas fraud audit methodology and continues to improve it with accumulated experiences. - [TRAINING] Expert Training

Accfam is seriously committed to developing many overseas auditing experts, not like small-town doctors who contribute to a small number of patients. This is an industry with a culture in which the expertise of the experts of self-taught rather than being taught. Accfam is focusing on developing overseas auditing experts through case-sharing within the company, a sharing system for expertise required for overseas auditing, and a thorough personnel development program. - [TEAM] Representative of Our Customer × Japanese expert from Accfam Head Office ×Expert from Accfam Local Office

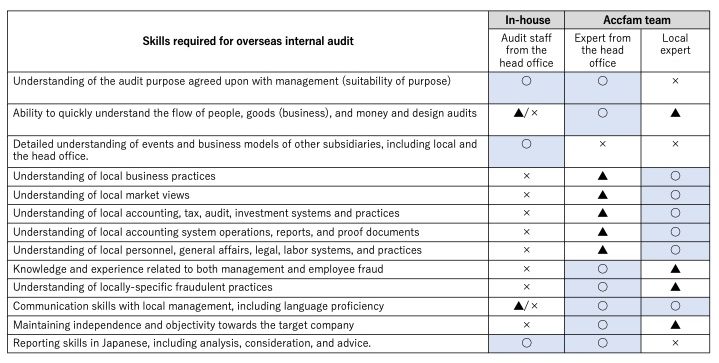

For Accfam ‘s overseas internal audits/investigations, we recommend conducting them through a three-party approach (co-sourcing) involving the company-side representatives who understand the target company’s business, our Japanese experts, and local experts. We have organized the necessary requirements for effective overseas audits and identified who possesses them based on our extensive case experience as follow:

We believe that a triangle team that leverages the strengths of each member and covers their weaknesses is a necessary indispensable requirement for effective international auditing.

PRICE : Price With a Sense of Cost-Effectiveness

Many overseas audit outsourcing firms hold local experts responsible for quality of the business and assign the final audit report, and the head office only engages in adding some values to it and its translation work. While it is correct in some ways to entrust a certain responsibility to local experts, there is a tendency to focus only on presenting the instructed work results lacking perspective of the head office which doesn’t solve the problem. In addition, the cost tends to be high, and there are many companies that want to use experts but do not have them. Accfam minimizes local costs by adopting a system in which experts from the head office take responsibility for quality control. These experts utilize the knowledge of local experts as necessary, and create the final audit report on their own, achieving high-quality overseas auditing with a sense of cost-effectiveness.

Network

Our company collaborates with local experts from various countries to carry out our business. What we believe is that consulting relies on people. In some emerging countries, it is difficult for small and medium-sized firms to secure and maintain excellent personnel.

Our Company does not have an exclusive partnership with its own base or specific firms. Instead, we select “Designated Consultants (DC)” from among many local specialized firms based on their expertise, flexibility, and reasonable compensation, and collaborate with them.

Currently, the countries with a track record of overseas audits or financial investigations conducted by our consultants are as follows:

China/ South Korea / Taiwan / Hong Kong / Singapore / Malaysia / India / Bangladesh / Sri Lanka / Vietnam / Indonesia / Thailand / Philippines / Australia / New Zealand / United States (Pennsylvania) / Tanzania

Currently selecting DC in the following countries:

Cambodia / Myanmar / Kenya

We plan to continue accumulating our record while expanding our carefully selected top-level expert network regardless of the size of the organization.

We can also respond for any request or tasks that may need to be carried out without collaborating with local experts in any country around the world.

Please feel free to contact us.